Do you know you can send foreign currencies (FX) from your

GT Bank domiciliary account without visiting any GT Bank branch? Before now, I

usually visit Bank branches any time I want to withdraw funds from my domiciliary

account. Sometimes, the bank branches tell me they don’t have enough

currencies. To stop these frustrating excuses, I started looking for better

alternative ways to withdraw funds from my domiciliary account without visiting

any bank branch. Luckily, I found a better and stress free alternative, which

is to send the foreign currency directly from your domiciliary account to the

receiver’s account. You will learn in this guide, how to setup your GT Bank

domiciliary account to send foreign currencies (USD, GBP, EUR, etc.), how to

transfer foreign currencies from your GT bank domiciliary account to any bank’s

domiciliary account.

Why you Should Setup your GT Bank Domiciliary Account to Transfer Foreign

Currencies (Benefits)

There are many reasons and benefits of setting up your

domiciliary account to be able send out foreign currencies. One of the benefits

is the ease and convenience of making transaction. With this you can now

transfer funds at your convenience, without stress. Even in times of emergency

(whether in midnights, weekends, etc.), you are covered.

Also, you can send funds to any domiciliary account holder

in any part of the world, regardless of the bank.

Lastly, for those who sell their funds to foreign currency

exchangers, you get a higher exchange rate when you sell your funds via direct

transfer from your domiciliary account.

What is a Domiciliary Account?

Domiciliary account (popularly called Dom Account) is a type

of savings or current account which allows you to send and receive foreign

currencies from any part of the world. It is specially meant for those who earn

in foreign currencies, and business men who use foreign currencies to import

and export goods. Domiciliary is simply any type of bank account that runs on

foreign currencies.

GT Bank gives you the option to create dollars, pounds and euros domiciliary accounts all at once. While most banks, you can only create one domiciliary account at a time.

See:

- Free Bitcoin Trading Profit/Loss MS Excel Calculator For Crypto Traders

- How To Convert A Docx File To Pdf And Other Format For Free Offline Using Ms Word

How to Setup your GT Bank Domiciliary Account to Send and Receive Foreign

Currencies without Visiting any Bank Branch

First, you need to get a hardware token (popularly called

hard token). A hardware token is a small (portable) hardware device that

generates a 6-digit, time-based code used for authenticating any transaction in

your online banking account. Go to any GT bank branch and request for hardware

token. You will be charged a one-time fee of 2,700 naira. A form will be given

to you. Fill and return it for processing. Below is an image of a hardware token.

Login to GTWorld app,

then use your hardware token ID to link your hardware token to your bank

account.

NOTE: Your hardware

token ID is a 10-digit number or code located at the back of the hardware token.

To link your hardware token to your GT Bank account, login

to your GTWorld app. From menu, go to Settings.

Then tap the Confirm Token link.

Enter your hardware token ID, and tap the Confirm Token button.

GTWorld will confirm your hardware token ID and link it to your bank account.

NOTE: Once you

have linked your hardware token to your bank account, you need to provide a

6-digit, time-based code from the hard token before any transaction you perform

in your online banking account platform will be authenticated, processed and

approved.

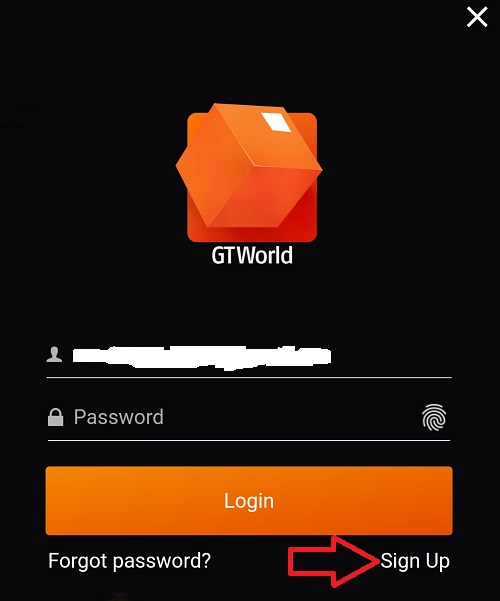

Next is to activate your hardware token. Open your GTWorld app. Tap the Sign in GTWorld button (but don’t login yet).

Then tap the Sign up link.

Next, tap the Get Online Banking Details (For Existing GTBank Customer) link.

Then go to the Token tab and fill in the required

details. Input the 6-digit, time-based code from your token hardware (hard

token). Finally, tap the Submit button.

Your username and a new time-based password will be sent to

the email address linked to your bank account. Use these details to login to

your GTWorld app, and then change your password.

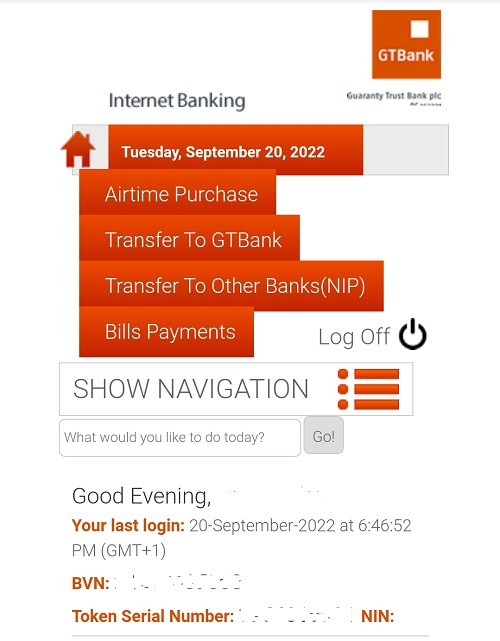

Now go to GT Bank InternetBanking Platform, and login with the updated login details of your GTWorld

app.

Congrats! You can now make transfers in your online banking

account with your hard token.

NOTE: Before you

can make third party transfers to another bank’s account from your GT Bank account

via online banking, you need to first add the recipient as a beneficiary using

your token device. This is to help secure your third party transactions.

Check:

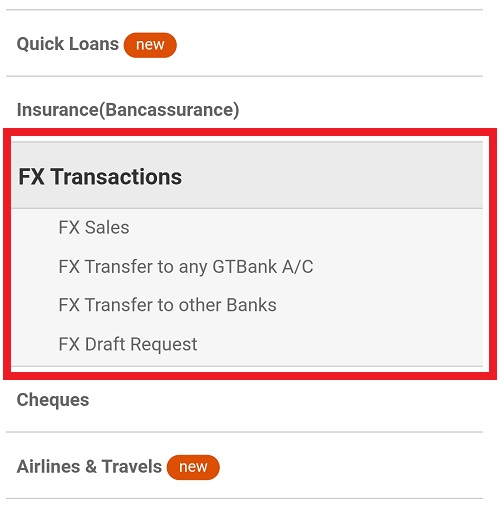

How to Transfer Foreign Currencies from GTBank Account via Internet Banking

Login to GTBank online banking platform. From the menu, scroll down and tap the FX Transactions. Then select either FX Transfer to any GTBank A/C or FX Transfer to other Banks.

Tap the New Request

button.

Now provide the required transfer detail (account to debit,

transfer amount, purpose of transfer, add either a new beneficiary or select

from stored beneficiaries, etc.). Answer your secret question. Agree to Terms

and Conditions. Then tap the Continue button.

Now provide the time-based, 6-digit code from your hardware

token needed to authenticate the transaction.

The recipient will receive the transferred foreign currency

once the transaction is authenticated, processed and approved.

Details of GTBank Charges per Transaction for FX Transfers

·

Commission:

0.5% of Transaction Amount.

·

VAT:

7.5% of Commission.

·

Telex:

6,000 naira (or its equivalent in the currency being transferred).

·

Off Shore

Charges: For USD - $25; For GBP - £12; For Euro – €20.

NOTE: For third

party transfer/payment in USD, BIC/Routing Number is required. All Forex

payments to the UAE require “Special Purpose Codes” and IBAN (Internet Banking

Account Number). Pounds Sterling transfers require Sort Code (a 6-digit number

that identifies the bank). While Euro transfers require IBAN and BIC (also

called swift code – an 8 to 11 character code that identifies your country,

city, bank, and branch).

Always ensure that your account is funded up to the required

amount including the transaction charges, to avoid your transactions being

rejected.

Also note that a hardware token is required to complete

third party transfers.

How to Add a Beneficiary to your GT Bank Domiciliary Account via Internet

Banking Platform

Login to GTBank online banking platform. From the menu, scroll

down and tap the FX Transactions.

Then select either FX Transfer to any

GTBank A/C or FX Transfer to other

Banks.

Tap the New Request

button.

In the Sender Details

form, scroll down to the Account to

Debit for Commission, VAT and Telex section. Tap the New Beneficiary button.

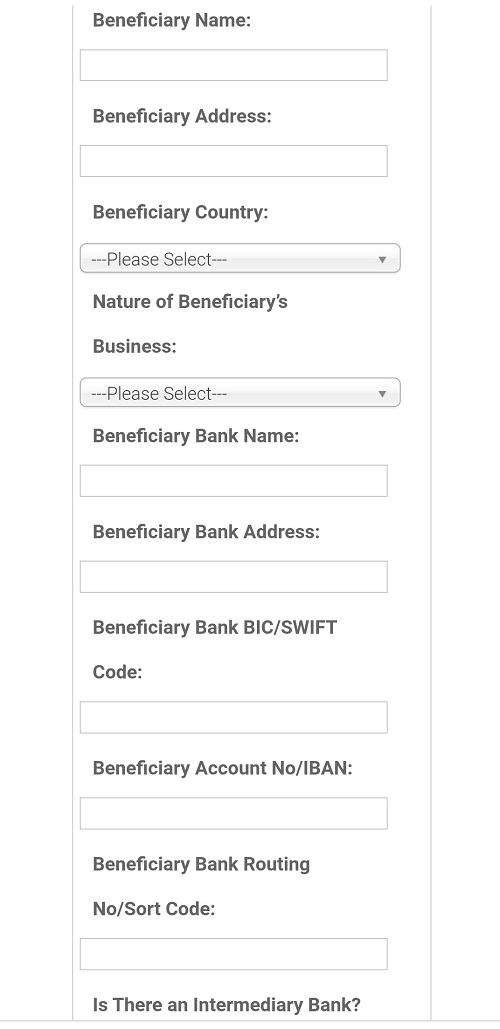

Now provide the needed details of the beneficiary (name, address, nature of business, bank BIC/SWIFT code, bank address, bank account number/IBAN, bank routing number/sort code, etc.

You can also check the Store

Beneficiary Details for Subsequent Transactions box.

See:

- How To Shop Online Safely With Your Credit Cards

- How To Turn Your Facebook Page Into A Shopping Mall In 10 Minutes

Conclusion

You have learnt how to setup your GTB internet banking

account to transfer foreign currencies, why you should set up your domiciliary

account to send out FX, how to add a new beneficiary to your GTBank internet

banking platform, etc. Now enjoy a stress free internet banking in your GT Bank

domiciliary account as a foreign currency earner.

No comments:

Post a Comment

WHAT'S ON YOUR MIND?

WE LOVE TO HEAR FROM YOU!