What-if analysis is one of the most important benefits of

Microsoft Excel as a spreadsheet application. Performing what if analysis means

changing the values of certain key variables in a formula or worksheet. It can

be performed using some of MS Excel’s powerful tools such as Scenario Manager,

Goal Seek and Data Tables. In this tutorial, I will give you a step by step guide on how you can manipulate and use these MS Excel Business tools: Scenario Manager and Data tables in various fields.

SCENARIO MANAGER

Scenarios Manager is one of MS Excel’s powerful what-if tools

used to substitute values automatically in a worksheet. It is used to calculate

loan amortization on what if basis. An example of a logical question that

Scenario Manager that Scenarios answer are:

If I decide to pay

back a 12 year $1000000 loan within

10 years on monthly basis, what then will be my monthly pay to amortize the

loan and what will be my total payback amount?

FUNCTIONS OF SCENARIOS

1. It is used in loan amortization analysis.

2. Scenario Manager is used to adjust values automatically in a

worksheet.

3. It is used to substitute values such as Loan amount, Interest

rate and Period automatically.

4. Scenario is used to summarize loan amortization.

5. It enables the user to calculate the monthly pay, total pay

and bank profit at the end of each period.

GENERAL STEPS TO CREATE A SCENARIO SUMMARY IN MS EXCEL

Now, I will give you the step by step guide to create a

summary for loan amortization or payment using the scenario manager in

Microsoft Excel. I will also illustrate it further with a practical example.

To Create a Scenario Summary for Loan Payment in MS Excel:

1. Prepare the loan amortization table and calculate the

monthly pay, total pay and bank profit using the PMT function as illustrated

above.

2. Click the Data tab,

then click the What-if Analysis drop

down arrow located in the Data tools group.

Then Select Scenario Manager from

the resulting options as shown below.

3. This prompts the Scenario

Manager dialogue box. Click Add and

then type in the scenario name or year.

4. Specify the Changing

cell that is the loan amount, interest rate, and period and click OK.

NOTE:

You either type the cell references of the changing cell or

click bolt icon at the extreme right to make a selection and then click on the

bolt icon again to commit your selection as shown below.

5. Next, enter a value for each of the changing cells and click

Add.

6. Repeat steps 3 to 5 for other set of values given. You can

always add, edit, delete or merge any set of value by selecting the appropriate

action button as shown below.

7. Click Summary and

specify the Result cells that is the

monthly pay, total pay and bank profit

8. Click OK.

DATA TABLES FOR WHAT IF ANALYSIS

Data tables help you to see results of multiple inputs such

as scenario inputs at the same time. It is used to compare different data set

output in MS Excel and for scenario summary.

TYPES OF MS EXCEL DATA TABLES

There are two types of data tables that can be used for

what-if analysis. They include:

1. One Variable Data table.

2. More than One Variable Data table.

ONE VARIABLE DATA TABLE WITH ILLUSTRATION

This type of data table is constructed when dealing with

only one key variable. The key variable in this case can either be the interest

rate or the periods of payment.

For example, to compute the monthly payment, total payment

and bank profit on a 20 year $1000000 mortgage with five different interest

rates: 15%, 16%, 17%, 18% and 19%, you will first prepare a worksheet as shown

below.

Enter the following formulas in the appropriate cells as specified

below:

For the Monthly pay; in cell B5, type: =PMT(B3/12, B4*12, B2) then press the Enter key.

For the Total pay; in cell B6, type: =B5*B4*12 then press the Enter key.

For Bank profit; in cell B7, type: =B6-B2 then press the Enter key.

To Prepare the Scenario Summary for the above example:

1. Click the Data tab,

then click the What-if Analysis drop

down arrow located in the Data tools group.

Then Select Scenario Manager from

the resulting options.

2. This prompts the Scenario

Manager dialogue box. Click Add and

then type in the scenario name or year. For example First interest, Second

interest, Third interest, Fourth interest, First interest, etc.

3. Specify the Changing cell

reference, in this case, interest rate

cell ($B$3) and click OK.

4. Next, enter a value for each of the changing cells. In this

case, 15% or 0.15 and click Add to

add the values for the subsequent key variable as shown below.

5. Repeat steps 2 to 4 for other set of values given, that is

for 16%, 17%, 18% and 19% respectively.

6. Click on Summary

and select Scenario Summary. Then specify the Results cells range, which is $B$5:$B$7.

Then click OK.

Your Scenario summary should resemble the one shown in the

worksheet below.

MORE THAN ONE VARIABLE DATA TABLE WITH ILLUSTRATION

This type of data table is constructed when dealing with

more than one key variable. The key variable can be all or any two of the

following: Loan amount, Interest rate and Period of payment.

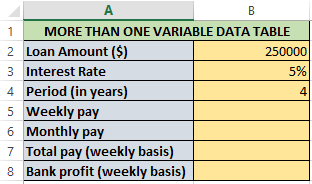

For example, Mr. Johnson is going for a loan of $250000 from

Diamond Bank to complete his house, the bank agreed to give him the loan on an

interest rate of 5% for a period of 4 years. If the bank Manager decided to

offer him $300000, $350000, $400000 and $450000 loan on an interest rate of

5.5%, 6%, 6.5% and 7% respectively, what will be his weekly pay, monthly pay,

total pay and bank profit on the weekly payment basis? Generate a scenario

summary for the above data.

THE MORE THAN ONE VARIABLE DATA TABLE SOLUTION

First, prepare your worksheet as shown below.

Enter the following formulas in the appropriate cells as

specified below:

For the Monthly pay; in cell B5, type: =PMT(B3/52, B4*52, B2) then press the Enter key.

For the Monthly pay; in cell B5, type: =PMT(B3/12, B4*12, B2) then press the Enter key.

For the Total pay (weekly basis); in cell B6, type: =B5*B4*52 then press the Enter key.

For Bank profit (weekly basis); in cell B7, type: =B7-B2 then press the Enter key.

NOTE:

in the above Total pay (weekly basis) and Bank profit (weekly basis) formula, I multiplied the period by 52 and divided the interest rate by 52 because 52 weeks make one year.To Prepare the Scenario Summary for the above example:

1. Click the Data tab,

then click the What-if Analysis drop

down arrow located in the Data tools group.

Then Select Scenario Manager from

the resulting options.

2. This prompts the Scenario

Manager dialogue box. Click Add and

then type in the scenario name or year. For example 1, 2, 3, 4, 5, etc.

3. Specify the Changing cells

range, in this case, the Loan Amount

cell and the Interest rate cell

(cell range = $B$2:$B$3) as shown below and click OK.

4. Next, enter a value for each of the changing cells. In this

case, the first key variable pair which is 5%

or 0.05 for the Interest rate cell and $250000

for the Loan amount cell as

shown below. Then click Add to add

the values for the subsequent key variable pairs.

5. Repeat steps 2 to 4 for other key variable pairs given, that

is $300000, $350000, $400000 and $450000 for the Loan amount and 5.5%, 6%, 6.5% and 7% for the Interest rate respectively.

6. Click on Summary

and select Scenario Summary. Then specify the Results cells range, which is $B$5:$B$8.

Then click OK.

Your Scenario summary for the two variable data table should

resemble the one shown in the worksheet below.

This is the end of part 2 of chapter 6 of this online tutorial series.

In the next part (part 3), I will explain another What If Analysis and Excel Powerful tools – the Goal Seek tool in MS Excel.

Recommended MS Excel Textbook

Get this book (Kindle format): Designing Professional Spreadsheet Management Systems Using Microsoft Excel 2013 and 2016.

Click Here to know more about the book.

In the next part (part 3), I will explain another What If Analysis and Excel Powerful tools – the Goal Seek tool in MS Excel.

Get this book (Kindle format): Designing Professional Spreadsheet Management Systems Using Microsoft Excel 2013 and 2016.

Was this tutorial helpful to you?

Inform your friends about this post by clicking the share button below. Comment below if you are hooked up along the installation process.

Also click Here to subscribe for free so that you will get our latest game updates in your email.

No comments:

Post a Comment

WHAT'S ON YOUR MIND?

WE LOVE TO HEAR FROM YOU!