If you have a US Adsense account, but don’t reside in USA or you are not from US, you will need to fill a tax form before you can receive any payment from google. You will be required to provide a Tax Identification Number (TIN) before you can submit the tax form or even get your Adsense payment. This is because you are US Adsense, and every United Citizen is issued a TIN which is used to track how much each citizen earns and how much to charge as tax. but since you are not a US citizen, it might be difficult to get this TIN. There are so many ways to request for the Tax Identification Number. This tutorial article guides you on the step by step guide to fill and submit the Google adsense W-8 BEN tax form using a valid virtual TIN/EIN/SSN/ITIN which will be issued to you instantly. This method works for any non US citizen or country.

Let's get started now!

How To Fill And Submit The W-8 BEN Tax Form

1. Login to your Google Adsense account and click on Settings > Payment. Next click on Manage Settings as shown in the screenshot below.

2. Scroll down to the Payment profile section. Next, click on the pencil icon near United States Tax Info and click on Add Tax Info as shown in the screenshot below.

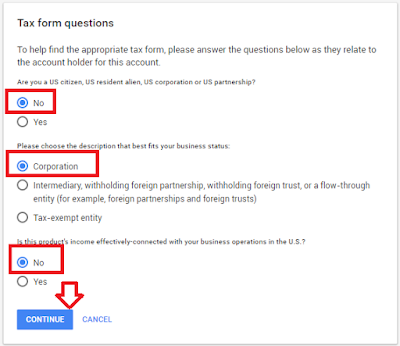

3. This takes you to the tax form page with questions. First you will be asked: Are you a US citizen, US resident alien, US corporation or US partnership? Select NO.

Next, you will be asked: Please choose the description that best fits your business status: Select Corporation.

Next, you will be asked: Is this product's income effectively-connected with your business operations in the U.S.? Select NO.

Then click on CONTINUE as shown in the screenshot below.

4. You will be presented with Form W-8 BEN Tax Info, which is for non-US citizens. For US citizens, they will fill Form W-9 Tax Info. Here, the most important aspect of the tax form starts. So pay great attention! You need to have a valid US address and a valid virtual Preparer Tax Identification Number (PTIN).

Read: The Causes Of Adsense Suspension/Ban And How To Avoid Them

In this form, you only need to fill Part 1: Identification of Beneficial Owner and Part 4: Certification. Don't fill Part 2 and Part 3.

5. For Part 1: From the Type of Beneficial Owner drop down menu, select Individual.

From the Country of Incorporation or Organization drop down menu, select your real country, not USA.

For the Permanent Residence Address, you need to provide a valid address which includes address, city and zip code. you can use the same address you used in verifying your adsense address. If you have already verified your address, the address you used will automatically appear in this section.

Before you continue with this tutorial article, read:

6. Once you have added a valid US address, check the "mailing address the same as permanent address" if it is so. Otherwise enter your mailing address.

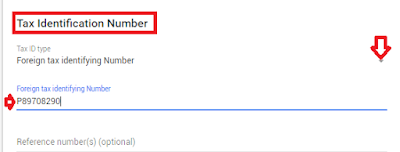

7. Under the Tax identification Number section, select Foreign Tax identifying Number. Then paste the PTIN you copied from the tutorial post whose link I gave some lines above. If you got everything right, your form should be similar as the one shown in the screenshot below.

Your completed part 1 of the W-8 BEN Tax form should be similar as the one in the screenshot below.

8. Now scroll down to part 4 of the tax form and read the certification terms and conditions. As I said earlier, ignore part 2 and part 3 of the form. Type in your full name in the space specified for the signature of the beneficial owner. Cross check and ensure that you got everything right as specified in this tutorial. Then Click on submit as shown in the screenshot below.

Conclusion:

I have clearly explained how to fill the US adsense tax form for non US citizens with screenshots to simplify each step. Once you have verified your adsense address and filled the tax form, you can now receive your adsense payment once you reach the threshold which $100 by default.

I know you have some suggestions and questions on how to fill the US adsense tax form with a virtual PTIN/TIN. I will be glad to hear it in the comment section below.

Also click Here to subscribe for free so that you will get our latest post and video updates in your email.

Please help us to reach your social media friends by clicking any of the share buttons below. Good luck!

i like your article...

ReplyDeleteGreat

ReplyDelete